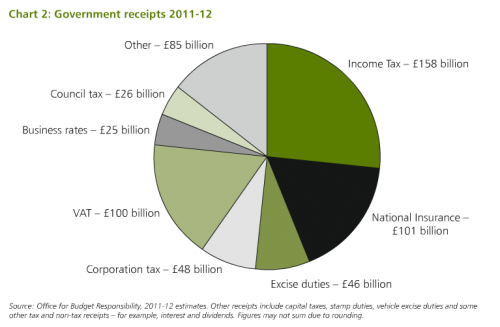

The UK Government income is based around tax receipts, typically:

- Income tax (main tax rate is 20%)

- National Insurance

- VAT (20% most goods and services)

- Corporation tax (main rate 21-20%)

- Council Tax (local government)

- Business rates

- Excise duties (alcohol, cigarettes)

- Other taxes include (stamp duty, carbon tax, airport tax, inheritance tax, capital gains)

Most tax is collected by HM Revenue and Custom.

However, the central government also get revenue from other sources which can be identified through {public sector finances at ONS (less detailed). Total tax revenue was around £90 billion.

Since the UK government has mainlined on balancing the books, and we live in an ever more expensive world where we all want more and more “stuff” including the government, then essentially every UK government is faced with either cutting spending or increasing revenue.

Since taxing more is unpopular, the emphasis has always been on trying to cut spending but we have had quite a few stealth taxes, increases to the lesser know or lesser observed taxes such as national insurance. One other wheeze is to push expenditure off onto local government, whilst limiting them to raise additional taxes through the local Council tax thus making local government the villain of the piece.

So if I was in charge of the government, what would I think about doing?

Honesty. Transparency. Fairness.

Let’s start with openly combining income tax and national insurance. In peoples minds they monitor the former very tightly and the latter barely at all and yet, they are all essentially the same tax, used interchangeably.

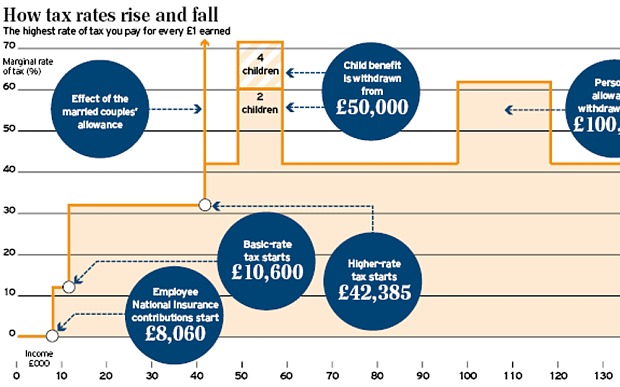

So although the headlines focused on raising the tax limit for income tax to above £10,000, it totally ignores the NI contributions payable from £8,060. Although the base rate of tax discussed is said to be 20%, taking into account NI means the lower effective rate of tax that most people pay is actually more than 30%.

We should be honest about this.

Honest. Transparent. Fair.

Income tax in the UK is largely taxed at source, deducted from pay packets before people have access to it and therefore for most people entirely unavoidable. It is essentially a progressive tax which takes a bigger % of income from higher earners. It is therefore also a fairly redistributive system.

It seems unreasonable to charge anyone more in tax than they are able to keep. Something feels unreasonable or unfair about the idea of taxing more than 50% of a person’s efforts but looking at the graphic above, it seems clear that aside from some very minor tweaks when child benefit is taxed and allowances lost, the highest effective rate of tax is just over 40%.

So what would happen if we set the basic rate threshold at £10,000 for the new combined all-income tax (income tax + NI) setting the rate at the current effective level of around 32%? This would be with a view to tweaking the rate up or down once people had got used to the combined all-income tax and the effects could be quantified in practice.

More of the poorest people should be taken out of tax entirely by avoiding NI contributions. Most people would pay slightly more at the lower rate (£600×32%- £192) which would hopefully pay for the lost NI income

And then suppose we leave the higher rate threshold unchanged but set the higher rate of combined all-income tax at 50% ie. higher than the current effective rate of 42% but not gouging. We should abandon all the claw-backs for child benefit and lower tax thresholds. The system would be simpler and easier to understand. It feels honest, transparent and fair.

Although the income tax system is progressive, other taxes are more regressive.

At 20% VAT tends to be more regressive. People on low income have a higher marginal propensity to consume. Therefore, the VAT they pay is a higher % of their total income. People on high income will spend more and will pay more VAT, but they will have a lower marginal propensity to consume (People on high incomes can afford to save a higher % of income). Therefore, VAT will be a smaller % of income spent. The regressive nature of VAT is slightly compensated by the fact that in theory, necessities like food (e.g. cold pastries, cabbages) don’t have VAT. VAT is supposed to be targeted at luxury goods. It’s also worth noting that a significant amount of income received by people on low income comes from the state in the form of benefits.

Other taxes like excise duties on cigarettes and taxes on alcohol are much more regressive. Smoking rates tend to be higher amongst people with lower incomes. Also, it will be a much bigger % of income than for rich smokers. We persuade ourselves that these taxes are for the health benefit of the individuals involved.

We could therefore consider intruding a sugar tax, on similar grounds, that high-sugar foods, especially those targeted at children are bad for their health. This is likely to be highly regressive since obesity is more commonplace amongst people on low income but it’s also likely to be popular with the voting public because of it’s health benefit.

Council Tax, a UK tax on domestic properties, can also be quite regressive and arguably unfair. People living in expensive areas end up having high housing costs, but also a higher council tax band. Arguably a fairer method of collecting local tax would be a local income tax but there are sizeable barriers to implementing any change. the minute a widow is forced out of her large (and expensive) house to pay her tax bill, is the minute a government gets into trouble.

Business rates are the property taxes charged on non-domestic problems and have recently been amended to allow local government to retain 50% amount raised rather than paying into a central pot and having money allocated back.

Inheritance tax raises a relatively small amount of money each year, at around £4.6 million a year but obviously this is in part because of significant tax planning for large scale landowners. The new Duke of Westminster will inherit control of an estate (held in trust) worth in excess of £9billion and pay no tax whatsoever.

It is not the business of the government to encourage the build up of inherited wealth within the hands of the privileged few. Any inheritance should be taxed as a receipt by the beneficiaries in the year in which the gain is realised, as part of the combined all-income tax. For people on low income, an inheritance would be subject to the standard tax bands and rates, treated as a top layer of income.

Since of most people the bulk of any inheritance is property, and the capital gains on houses are not the result of any intrinsic hard work or merit, it seems unreasonable to encourage windfalls for the next generation through any tax system.

It also seems unreasonable to ask the state to fund care in old age in order to preserve any such inheritance for the next generation. Treating any inheritance as windfall income should reduce the temptation to preserve wealth at the expense of paying for a decent standard of living, including care costs in old age.

Another much discussed problem with the UK tax system is the scope for having offshore accounts and avoiding paying tax through tax avoidance schemes. Tax avoidance is often easier by people with high incomes. Unfortunately it is also perhaps the most expensive problem to address since high income people can afford high fees for good advice.

So my no doubt incredibly unpopular suggestions for change on the “income” side of the puzzle include:

- Combining Income Tax and National Insurance

- Set the threshold for basic all-income tax at £10,000

- Set the tax rate for higher rate tax payers for the new all-income tax at 50%

- Abolish the various tweaks re: child benefit and removing nil bands

- Introduce a sugar tax

- Abolish inheritance tax and treat any inheritance as a windfall to be subject to the all-income tax as a top layer of income.

Not going to happen.